Glitch Weekly: The new crypto game even your normie friends will want to play

Also: Crypto’s first big triumph in Washington, and the legal status of “sandwich attacks”

Happy Friday! The past week brought a tidal wave of crypto news. Let’s go surfing.

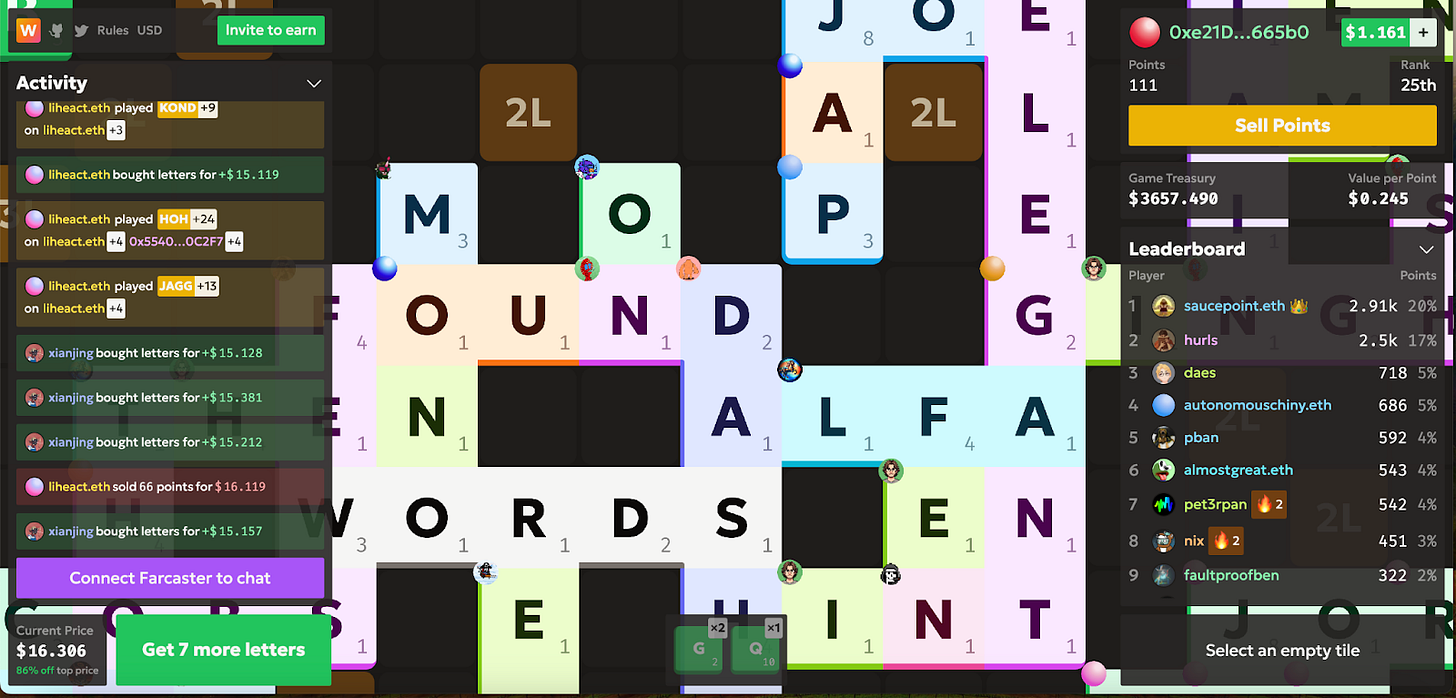

Words3 is like Scrabble, but “infinite” and with real stakes.

The New York Times’s roster of puzzles—including Connections, the Quick Crossword, SpellingBee, and my personal favorite, Wordle—has proven so popular that people now spend more time with NYT’s games than anything else the company produces.

That’s part of why, when I saw Words3, a new blockchain-based game created by an independent game development studio called Small Brain Games, I was intrigued.

Words3 takes the form of an “infinite” online Scrabble board, and the rules of the game are familiar: players earn points by buying tiles and playing words. In Words3, you get more points if other players build on your word.

Not only does the board never end, but because its logic lives on a blockchain, Words3 can in theory exist forever. “Play now or in ten years,” tweeted Small Brain, the pseudonymous game developer behind the game studio of the same name, when he announced last week that Words3 was live.

One clever thing about Words3 is that, unlike in traditional Scrabble (tradScrab?), you can sell your points for cash (the money people use to buy tiles goes into a treasury, which is where the cash comes from). This creates a compelling trade-off—selling points means you can buy more tiles, but potentially comes at the expense of your clout.

A leaderboard of active players is displayed on the right side of the screen and, on the left, an activity feed shows what's happening in the game. You can see each player’s stats, down to what their cost-per-letter was, how many points they’ve sold, earnings-per-point, and every word they’ve ever played. There are currently just over 100 accounts showing on the leaderboard.

What’s that, normie Wordle fanatics? You want to play Words3? You should! But be aware that there’s a small catch: You have to buy in to play, and working out how to buy tiles in the first place requires a number of confusing steps that might stymie even the most discerning puzzler.

First, you need a crypto wallet with some ETH (that’s a cryptocurrency) in it. When I tried to buy ETH to play, my bank blocked my card for some undetermined reason. Luckily, unbeknownst to the UK financial system, I had some crypto stashed in an old Metamask wallet, alongside long-forgotten cat NFTs.

Even with this fresh bounty, when I connected my wallet, the game said I didn’t have enough ETH for my first seven letters. This was because I hadn’t yet “bridged” my crypto to the Redstone Network—a specially built “Layer 2” (here’s more on the Layer 2 concept, if you are interested) for crypto games. In short, Layer 2s are designed to reduce transaction fees and make blockchains speedier.

Once I'd worked out how to transfer my magic internet money to Redstone, it was game time. My initial strategy wasn’t well thought through; I blazed through nearly $100 just trying to work out what was going on. But as time went on I started cashing in points, worked around a dreaded Q in my deck, and played a 22-pointer. I was hooked.

The big lift in making this kind of game accessible to the masses is, of course, down to making all the back-end transactions—buying the crypto, bridging it to the right network, and so on—a one- or two-click process. That’s no mean feat in an industry that has always struggled with its user-friendliness. But once you’re past the digital maze, the reward mechanism baked into this onchain Scrabble dupe makes it compulsive. I didn’t think twice before shelling out in pursuit of anything but another “E”. I’m 19th in the rankings as we are sending this newsletter—more than 2,800 points behind the top-ranked player, who has spent nearly $900 dollars to dominate, with words like OVERZEALOUSLY and NONREFLEXIVE.

For now, I’m biding my time, waiting for the cost of a new set of tiles to fall below $15 before I can gazump my way into the top 15. —Lucy Harley-McKeown

Crypto finally got a win in Washington. Now what?

If it wasn’t clear last week that the political tide has turned for crypto in DC, it sure is now. Enthusiasm for crypto has prevailed over the “anti-crypto Army” that mobilized in Washington in the wake of the FTX nightmare. The opposing force seemed to bet that crypto would never wake up again, a wager that mistakenly ignored the underlying technology.

On Wednesday, the US House of Representatives voted 279 to 136 in favor of passing a bill championed by many in the crypto industry, called the Financial Innovation and Technology for the 21st Century Act (FIT 21 for short). A few weeks ago the bill, authored by a handful of longtime pro-crypto Republicans, seemed unlikely to garner Democratic support. When it passed, it did so with some 70 Democrats voting in favor.

The bill’s passage is the culmination of a monumentally successful two weeks—politically, at least—for the crypto industry in DC. Last week, the Democratic-led Senate defied a veto threat from the White House to pass a bill that would repeal an obscure accounting rule that the industry said hampered the ability of financial institutions to custody crypto-assets for their clients. Pro-crypto comments by Donald Trump the week before may have helped trigger the shocking shift in the political winds by spooking Dems into thinking Trump may try to make crypto into a wedge issue in this year’s election.

As the vote on the FIT 21 neared on Wednesday, optimism was palpable at a morning gathering of policy-focused crypto enthusiasts in DC called Pretty Good Policy for Crypto. “It feels like we are finally starting to win the political battle, winning hearts and minds in Washington DC in favor of crypto in a way that we really haven’t before,” crypto focused lawyer Jake Chervinsky told the group via a remote livestream.

Chervinsky, who recently left the advocacy group Blockchain Association and became chief legal officer at a venture capital firm called Variant, said passing a bill like this “legitimizes” the industry. It’s a rebuttal to its adversaries on the Hill who don’t agree that “this technology is important enough and unique enough that it deserves its own regulatory framework,” he said.

What’s next?

As excited as Chervinsky was about the political win, however, his tone quickly shifted when he began discussing some of the policy details in the bill. “Although this bill is a political victory, my view is that it is not a policy victory,” he said. He warned that if it were to become law as is, it could lock in policies that have unintended negative consequences.

He’s far from alone in this view. FIT 21 aims to settle a political conflict over crypto that has been simmering in DC since at least 2017, when people started using Ethereum to create new tokens seemingly out of thin air. This capability catalyzed a boom in initial coin offerings (ICOs), in which crypto ventures raised money by selling tokens to be used later, often in a yet-to-be-built network or application. Eventually the US Securities and Exchange Commission crashed the party by taking ICO projects to court for allegedly selling unregistered securities.

Under current chair Gary Gensler, the SEC has taken a particularly aggressive stance on the issue, arguing that most cryptocurrencies on the market are in fact securities. The agency has gone so far as to imply in a recent court document that it might even consider Ethereum’s cryptocurrency, ether (ETH), a security.

The lack of a formal definition of a digital asset, and agreed-upon criteria for how to determine whether an asset is a security or something else, like a commodity, has also led to disagreements over whether the SEC or the US Commodity Futures Trading Commission (CFTC), which oversees derivatives markets, should be the main regulator of crypto markets. Just before FIT 21 passed, Gensler issued a strong statement in opposition to the bill, arguing that it would “create new regulatory gaps and undermine decades of precedent” and let many crypto-assets that should be governed like securities off the hook.

The goal of the FIT 21 is to provide “clarity,” Rep. Patrick McHenry of North Carolina, Chair of the House Financial Services Committee and co-sponsor of FIT 21, said on the Bankless podcast this week. “Currently in federal law we have no definition of what is a digital asset,” he said, arguing that this has left the door open to “fraudsters” like Sam Bankman-Fried. The law makes clear that “if you are a digital asset, and you are truly decentralized, you are a commodity,” and will be regulated by the CFTC, McHenry continued. “And if you’re not decentralized then you are probably a security.” FIT 21 also includes a methodology for determining whether a given crypto network is decentralized enough to be called a commodity.

A number of prominent crypto lawyers have expressed dismay over this approach. “Man we have been psyopped so bad on this FIT 21 thing,” tweeted Gabriel Shapiro, founder of MetaLex Labs. It amounts to handing new power to the CFTC and “hoping they are not insane fascists,” he added.

Chervinsky argued that splitting the power over crypto markets between two agencies is a “fatal flaw” in the bill because it leads to “two entirely separate markets that cannot talk to each other, and most importantly cannot talk to markets overseas.” Crypto should be “a single, liquid, transparent and efficient” global market, he said. “This bill abandons that idea in the name of political expediency.”

Accepting this central compromise would also mean acquiescing to some kind of decentralization “test”—and that could backfire later on, Chervinsky argued. The bill “basically says we understand right now, in 2024, very rigid metrics that are necessary for a network to be decentralized, and never again will those metrics be changed and we will close off the idea of new innovation—new types of networks that have yet been conceived that might not fit this very strict definition.”

The bottom line is that although they’ll take the political W that FIT 21 symbolizes, many pro-crypto legal minds seem to dislike the policy details just as much as their regulatory nemesis, Gary Gensler—albeit for different reasons. Perhaps the details ultimately don’t matter so much, since the chance the Senate votes on a corresponding bill before the election in November are extremely slim. Either way, the crypto industry has planted a flag in DC, and that was the hard part. Now comes the tedious and excruciatingly difficult part. —Mike Orcutt

The DOJ just made an obscure crypto phenomenon much less obscure.

Let’s say you’re a clever crypto trader and you want to take advantage of the price volatility of your favorite crypto-token on the Ethereum blockchain. Let’s call this hypothetical coin $SHIT. You know that if someone places an order on a decentralized exchange—Uniswap, say—to purchase a large pile of $SHIT, the price of $SHIT will predictably go up. And you’re in luck: because of the way the blockchain works, you can see the future. All you have to do is peer into the “mempool” (technically you’ll need to create a bot that can do this).

That’s the crypto term for the public record of pending Ethereum transactions waiting in line to be packaged into new blocks—the bundles of transactions the network’s validators get paid to process and add to the chain every day. If your bot looks into the mempool and happens to see a pending “buy” order large enough to inflate the price of $SHIT, it can jump the line in a way that ensures you profit. All it needs is enough money to stand up the buy order at least equal to the value of the big order of $SHIT that you’re deciding to exploit.

With those things in hand, it’s possible—again, due to the way that decentralized exchanges work—to place an identical order to buy $SHIT tokens and ensure that it gets processed before the other person’s order, such that you inflate the price of $SHIT yourself, just before the same unwitting buyer raises the price even more. Then you can sell the $SHIT back to the market at a higher price than what you purchased it for. In crypto circles this is called a “sandwich attack” because you’ve “sandwiched” the other person’s order between a buy and sell order.

Sandwich attacks aren’t new. But until last week, they remained an extremely obscure topic, in no small part because hardly anyone understands what they are. Then the US Department of Justice indicted two sandwich attackers. Well, it indicted two sandwich attackers who pulled a sandwich attack on a group of other sandwich attackers. The DOJ has never indicted anyone for something like this before, but the elaborate scheme they set up, which involved setting up their own network validator and attacking fellow sandwich attackers, apparently was a bridge too far.

On the Ethereum network, sandwich attacks are possible because of a feature (or bug, depending on how you look at it) called maximum extractable value (MEV). It refers to the sum that the network’s validators can get paid to add blocks to the chain. The system allows people to bid a “priority fee” or “tip,” on top of a network flat fee, to make sure their transactions are executed before other transactions in the block.

In crypto circles, MEV is known as a kind of necessary evil of the block-creation protocol that finalizes batches of transactions. Similar problems exist in the traditional financial markets, particularly in the realm of high-frequency trading. One traditional term for the phenomenon is “front-running.”

The new indictment charges two twenty-something MIT grads, who also happen to be brothers, with fraud and money laundering offenses and alleges that they stole $25 million from the Ethereum blockchain through a “technologically sophisticated, cutting-edge” scheme.

Whether or not they did anything wrong is now for a court to decide—no longer just a small, obscure group of crypto experts. For what it’s worth, the indictment points out that they did spend a lot of time Googling “how to wash crypto” and the basics of “money laundering.” But they also exposed a vulnerability in Ethereum that’s likely helpful to know.

It’s become a common theme in crypto-land: did these crypto bros break the law or do they deserve a bug bounty? Both might be true. —Sam Venis

ODDS/ENDS

In yet another political win for crypto, the SEC has approved exchange-traded funds (ETFs), tied to the price of Ethereum’s cryptocurrency (ETH)—traditional financial products that the industry has wanted for years. The approvals “enshrine” the SEC’s position that ETH is not a security,” tweeted Miles Jennings, an attorney who advises crypto founders for VC firm Andreessen Horowitz.

Prominent crypto critic Molly White has come out swinging in defense of the developers who created Tornado Cash (a story we’ve been following closely here at Project Glitch). To those who may be surprised, White—who is known for her criticism of the crypto industry—wrote: “I have long repeated that I share many of the same ideals as some—particularly the more ideologically- rather than business-motivated—in the cryptocurrency world.” Her criticism, she reminded her audience, has mostly focused on educating people about the rampant crypto scams and frauds. But if the arguments that governments are making against the Tornado Cash developers prevail, she wrote, “the government will score another point against the use of cryptocurrency and cryptocurrency mixing services by bad actors and by those who are trying to achieve financial privacy for more legitimate reasons.”

The US House of Representatives passed a bill called the “(Central Bank Digital Currency) Anti-Surveillance Act.” The bill amends the Federal Reserve Act to “prohibit” the Fed “from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes.”

What is Project Glitch? In case you haven’t figured it out by now, here’s Mike Orcutt explaining to a gathering of DC crypto policy watchers why we exist and what we care most about. In short, we want to inspire better conversations.

Follow us on Twitter or get corporate with us on LinkedIn—if you want.