Despite its powerful haters, crypto keeps getting more legitimate

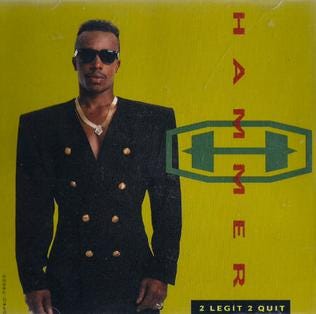

Too legit to quit

The Glitch is back! Welcome to 2024. Our only prediction for the new year is that technology and the way we use it to interact will get even weirder.

In this issue:

Stuff that has us like 👀

Succinct’s zero-knowledge computing platform, explained

ODDS/ENDS

Like it or not, crypto just got more legitimate. First, let’s acknowledge how weird it is that so many crypto fans are euphoric that the US Securities and Exchange Commission has finally approved exchange-traded funds (ETFs) that track the price of Bitcoin. It reflects a distinct brand of cognitive dissonance that many enthusiasts seem happy to live with.

The dissonance has to do with legitimacy. It’s tough to quantify, and what qualifies as legitimate changes over time. But many crypto enthusiasts are impatient for mainstream legitimacy, and frustrated by the popular image of their field. A common lament on social media goes something like this: The public thinks crypto is bad because the media and anti-crypto politicians only focus on the bad stuff, like SBF, and how terrorists and criminals find the technology useful! Why don’t they understand that we are reinventing the financial system and saving privacy!?!

Why do so many “normies” fail to see crypto as legitimate? Maybe the emphasis on the dark side by the media and adversarial politicians is part of the reason. But it could also be in part because so many crypto heads tend to make a habit of railing against all manner of traditional institutions, from the very idea of the nation-state to banks and the SEC, in some cases even cheering for their demise.

The problem for the folks hungry for legitimacy is that the SEC, in particular, gets to say what is and isn’t legit. The agency has generally been skeptical of cryptocurrency since the initial coin offering (ICO) era more than six years ago. More recently, some crypto advocates and influencers have resorted to antagonizing the agency and its chair, Gary Gensler, which has only seemed to make matters worse.

Something may be changing, though. The SEC had rejected more than 20 prior ETF proposals dating back to 2018, typically citing the risk of market manipulation. Then, last year, a US court of appeals in Washington, DC held that the Commission failed to adequately explain its decision to reject one of those filings, by influential crypto firm Grayscale Investments. Gensler acknowledged in a statement that he only voted to approve because the court essentially made him do it.

This outcome is odd. As Bloomberg’s Matt Levine noted when the court initially made its decision in August: “For most of my time watching financial markets, the courts and the financial industry have broadly deferred to the SEC as the expert financial regulator.” In other words, the arbiter of what constitutes a legitimate investment asset. That may be changing, Levine argued, due to an aggressive stance by the SEC toward crypto, and the crypto industry’s aggressive pushback in the courts.

Whatever the cause, the effect is that traditional (legitimate!) financial institutions are now allowed to offer their clients exposure to Bitcoin. And even though it only works through a more traditional (legitimate?) asset, cryptocurrency as an idea just got less fringe. —Mike Orcutt

The problem with Vitalik’s “shared hard drive” meme. Ethereum co-creator Vitalik Buterin seems just as anxious for legitimacy as any other crypto nerd, but for him, the goal isn’t to convince people that Ethereum is a legitimate investment asset. He’s determined to convince them that it works.

What is it? He’s always refining the answer, and in his latest blog tome he gave us an update. He also repeated an analogy he’s used before: Ethereum, along with zero-knowledge proofs and “sister technologies” like decentralized file storage network IPFS, can be humanity’s “shared hard drive.”

Why do we need one of those? Because of how the nature of software and work has changed, he argues:

“When the free open source software movement began in the 1980s and 1990s, the software was simple: it ran on your computer and read and wrote to files that stayed on your computer. But today, most of our important work is collaborative, often on a large scale. And so today, even if the underlying code of an application is open and free, your data gets routed through a centralized server run by a corporation that could arbitrarily read your data, change the rules on you or deplatform you at any time. And so if we want to extend the spirit of open source software to the world of today, we need programs to have access to a shared hard drive to store things that multiple people need to modify and access.”

It’s a good story, but it’s never managed to catch on outside crypto circles. Perhaps that’s because for most people the antagonist in the plot (corporations that run centralized servers, muhaha) is usually invisible and seems relatively harmless. A shared hard drive might seem like a solution in search of a problem. As Buterin has argued before, however, AI is likely to make the problem much clearer. —Mike Orcutt

WARNING: TECHNICAL

Name: Succinct

Brain(s) behind it: Succinct, the startup behind the platform with the same name

What it is: To put it—er—succinctly, the product is supposed to be sort of like an Amazon Web Services (AWS)-style platform for zero-knowledge (ZK) programming. A one-stop shop for people building applications at the cryptographic frontier.

ZK cryptography enables one party (the prover) to prove to another party (the verifier) that a given secret is true—without revealing the secret itself. Technology based on it was mostly theoretical until the past several years, as tools and platforms have emerged that make it possible to program applications that use ZK. The budding ZK ecosystem is now one of the most hyped areas in crypto, as many believe the technology can be used to protect sensitive data about people’s health, prove work or educational credentials, or even hold the key to national identity documents. It could also be used to make blockchains more efficient computers, by securely outsourcing computation to machines separate from the chain.

In November, at Ethereum’s DevConnect in Istanbul, I used an app called Zupass, which used ZK to prove I had a ticket without revealing my identity. That’s also when I had the opportunity to listen to Succinct’s CEO, Uma Roy, explain the company’s mission.

Despite the promise of ZK technology, a big challenge facing developers today is how fragmented the space is, said Roy. Developing and deploying a ZK product is a “total nightmare” due to arcane programming languages and no central repository for seeing what other people are building, she said. She added that individual projects operate in a “monolithic” way, and there is little in the way of interoperability.

The Succinct platform coordinates the sharing of fast-evolving APIs and custom-built tools. Succinct wants to create standards via an “open infrastructure layer” featuring a new architecture and marketplace designed to accelerate the development of the ZK ecosystem.

Roy described blockchains as “restrictive computational environments,” which sacrifice “functionality in the name of limited compute resources.” So the new platform is designed to bring disparate computing resources together so that developers can access “unlimited computation.” The idea is to use ZK to verify facts independently of blockchains, and then record those proofs on the chain. This is far less computationally intensive than relying on the blockchain network to do the computing.

The platform, launched in November, gives access to so-called 💡light clients, which the company says will make it easier for developers to build applications that bridge multiple blockchains. Light clients provide a verified proof of consensus, which can be used to form information highways between different domains.

The platform also features 🤖machine learning tools, which developers can use to create on-chain apps that integrate “autonomous agents,” generative art, or other customized user experiences that use ZK in some way.

Finally, Succinct gives developers access to new types of 🔮 oracles, the crypto term for a connection between a blockchain and a source of data, like a price feed, from the outside world. The platform replaces these with cryptographic proofs.

“We’re just at the start of what’s possible with ZK,” says Roy. “Every year you can stuff more computation in these verifiable proofs, and get more access to compute on-chain.” —Lucy Harley-McKeown

ODDS/ENDS

Coin Center has clapped back at Elizabeth Warren. The crypto-critical senator had sent the think tank a letter asking for details on its employment of former defense, national security, and law enforcement officials, bemoaning “abuse of the revolving door” and accusing the industry of “spending millions to give itself a veneer of legitimacy” while “fighting tooth and nail to stonewall common sense rules designed to restrict the use of terror for crypto financing.”

Coin Center Executive Director Jerry Brito had something to say about Warren’s tough talk. “With respect, we have no obligation to answer these questions beyond the public disclosures we make under the law,” he wrote in a response. The reason Coin Center opposes the legislation she cites, Brito wrote, “is that they are not ‘common sense rules’ as you style them, but are instead unfair, unworkable, and most importantly, unconstitutional proposals.” He added: “We also oppose these legislative proposals precisely because we are concerned about Hamas’s abuse of crypto networks. Legislative proposals like yours would not only do nothing to address the problem, they waste time and energy that could be properly spent on proven approaches like enforcing existing law against foreign rogue exchanges that are invariably at the center of terrorist use of crypto.” 🍿

The New York Times has sued Open AI and Microsoft for copyright infringement. The newspaper argues that articles it published were used to train AI chatbots that are now competitors as a source of reliable information. The suit contends that OpenAI and Microsoft should be held responsible for “billions of dollars in statutory and actual damages.”

“Shoddy AI clones” of Joe Rogan, Taylor Swift, The Rock, and others are appearing in YouTube ads for Medicare and Medicaid scams, reports 404. Such ads have been viewed nearly 200 million times.

Venezuela is shutting down its six-year-old state-backed cryptocurrency, the petro. The currency, which President Nicolás Maduro created to circumvent US sanctions, never took off and became embroiled in a corruption scandal.

Fox Corporation has released a beta version of Verify, “an open source protocol meant to establish the history and origin of registered media” developed by crypto firm Polygon. According to a press release from Polygon, “publishers can register content in order to prove origination.” Then, “individual pieces of content are cryptographically signed onchain, allowing consumers to identify content from trusted sources using the Verify tool.” 🤔

Cryptography researchers have developed a “clever” idea that would preserve the ability to detect malicious Apple AirTags, which have been used by stalkers, while also maintaining “maximum privacy for other AirTag users,” according to Wired.

Gamestop has killed its NFT marketplace, only a year and a half into the project.

Blackrock chairman and CEO Larry Fink says his firm sees the SEC’s approval of spot Bitcoin ETFs as a “stepping stone” toward the eventual “tokenization of every financial asset.”